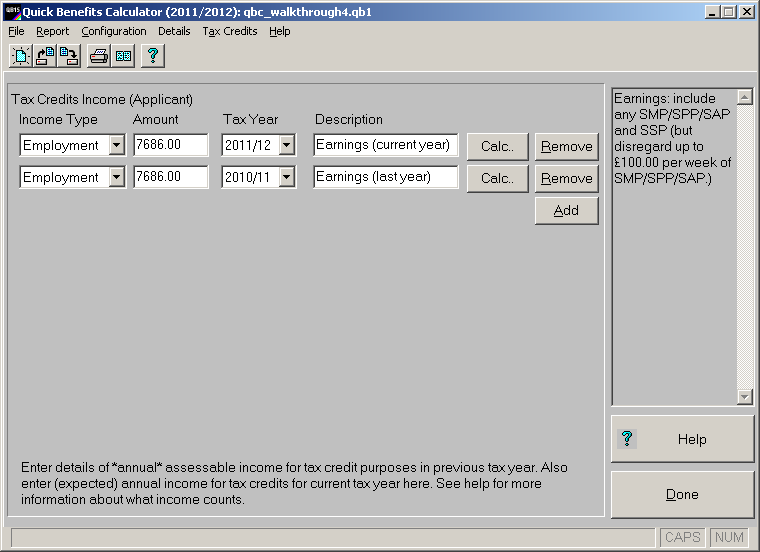

Step 4

Tax credits are assessed on income over full tax years, and income details for both current and previous tax years are often needed. Because of this, income for tax credits must be entered separately. Jane's earnings have not changed over the past two years, so Sally must enter the annual amounts on the tax credits income worksheet. The program can be configured to calculate these automatically. Sally clicks Done to return to the main screen.